Updated March 2020

We love to travel and lots of our friends seem to think we are always travelling. This post is 6 things that we do regularly to help us to be able to travel more often. Some of these things are to do with timing but others are conscious choices that we have made.

We use these tips to be able to travel more often but the same principles apply if you are hoping to save for anything a wedding, new car, or home renovations.

Table of Contents

1. We make travel a priority.

As a family, we love to explore new places and see the world. Making travel a priority in our house makes it much easier to not buy that takeaway coffee or to pack lunch to take to work each day. If you know that by skipping unnecessary spending now you will get a bigger benefit later it can help to keep you motivated.

2. We have a weekly budget

For a lot of people, budgeting is something they hate to do. Growing up with an accountant it was something I heard a lot about. I will admit that although I have been ok with writing budgets in the past, sticking to them has been another story.

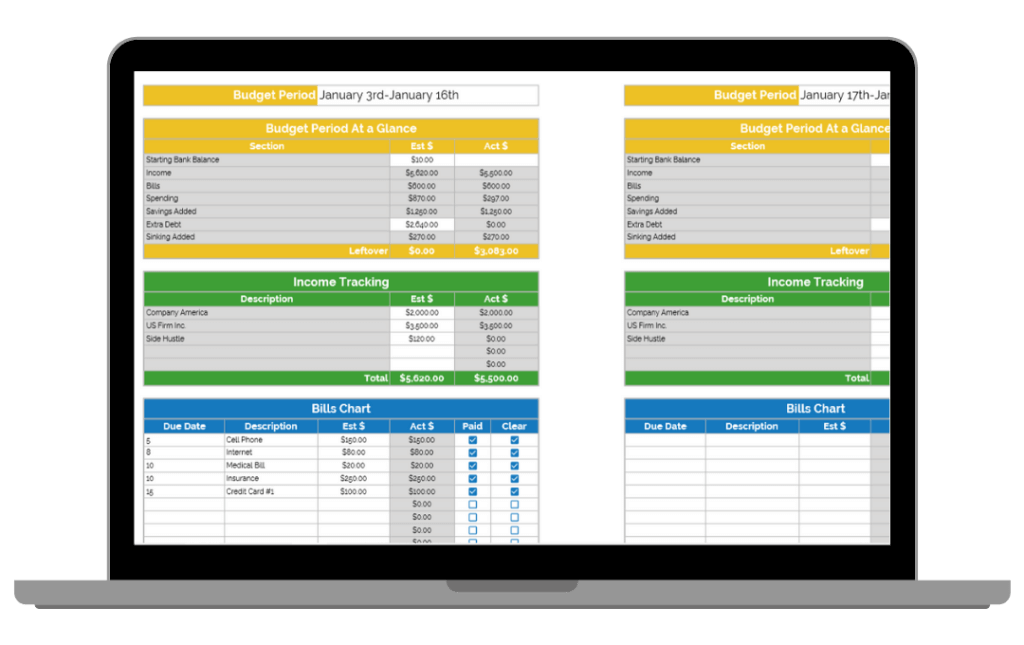

This year when we decided we wanted to go on this big trip, we made a point of deciding that we wanted to pay for as much of it as we could before we went. Instead of having to pay off a credit card when we got back. I discovered Sami Womack of A Sunnyside Up Life and have been using a variation of her budgeting sheets. We find these very helpful. She has recently updated them. They are simple to use and now have pretty graphs to show you how you are progressing towards your goals. I have been able to allocate money for our holiday in every budget period which has made it much easier to stick to a limit in other areas.

3. Designated holiday savings account

With ING we have been able to easily set up and online savings account for holidays. So all the money I allocate in the pay period gets transferred to the savings account and then as we need to pay for something it comes out of that account.

The other thing ING does is an automatic round-up. You can set up your main account so that it rounds up to the nearest dollar or five dollars. We only did the dollar one. Then whatever round-up is automatically sent to your allocated account, for us the holiday account. For example. If you spend $40.57 on petrol it will automatically send the extra 43c to your savings account. It is small amounts you don’t notice, but over time it can get you closer to your savings goal. Also, their app is great so I can look on my phone and just scroll across to see how the account is going.

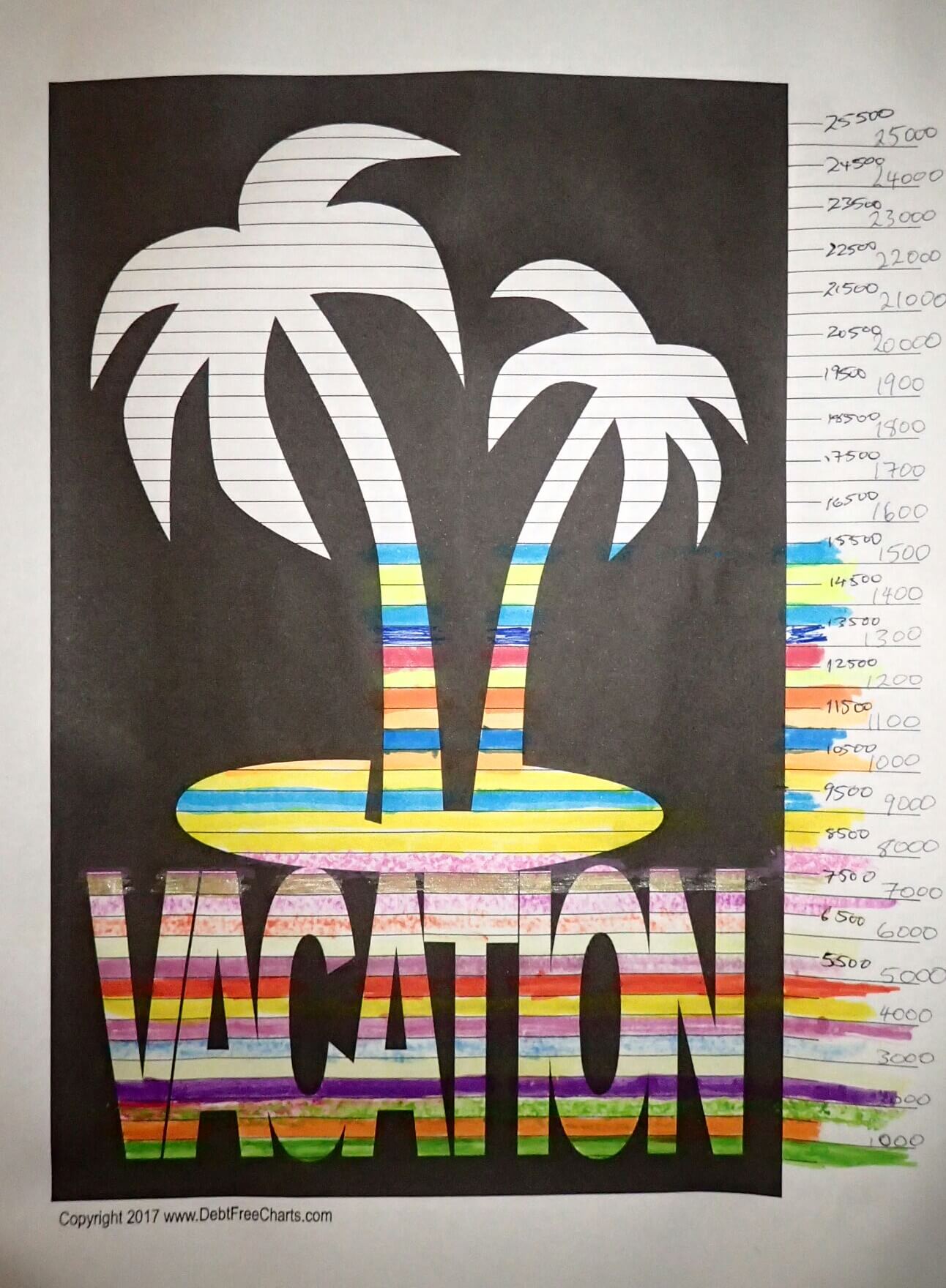

4. Visual guide

To go along with our holiday account, we have been using a chart from Debt-free charts which has heaps of charts that are free or you can get more personalised ones for a small fee. About $1 USD. Each time we transferred money to our holiday account we would colour in a different section of the chart. A very good way to keep us motivated towards our holiday savings goal. I can’t wait each week to colour in another section of the chart every time I transfer money to the holiday account. They are also good for other savings goals you might have.

5. A Smaller mortgage

We had the advantage of buying our house ten years ago. Obviously, not everyone has that option available to them. But the conscious decision we have made around this was not to upgrade or do a major renovation. Over the years we have thought about buying a bigger house or renovating our house. But when we made travelling more often our priority it helped us to be happy with our smaller house. We would rather have a smaller house and travel more often than have a bigger house, ie bigger mortgage and hardly ever be able to travel.

6. Minimalism

What initially led me to minimalism was how relaxed I felt with less “stuff” when we were travelling. I knew I could manage without all the things I had at home. One of the other things that changed our mind about a bigger house was learning about Minimalism. Having fewer things means we are buying less. This gives us more money for our holiday savings account.

We are still working on minimalism in our lives. Our children can’t quite see the benefits yet. With our dream trip of travelling around the world for months at a time, minimalism will help us to have less to store from our home. We still have a few years to work on it. Eventually, when we reduce what we have further, our little house will be a spacious house.

I would love to hear from you. Do you have any things that you do to help fund your travelling dreams? I hope this might inspire you to try some of these ideas to help you travel more often or reach your own savings goals.

*Some of the links in this post may be affiliate links. If you buy using the link you will not pay more but Our travelling clan may get a small commission.

It’s all about priorities for us. We don’t need savings plans and budgets and all that stuff any more. We did when we were saving to leave, but now travel IS our life, it’s not necessary. We don’t waste money on stuff we don’t need, it’s as simple as that. New clothes come when we need them, we never have more than 2,-3 pairs of shoes each, usually hiking boots, flip flops and running shoes for the 3 of us who run. We have to carry everything in back packs so there is no temptation to buy junk. And if we need more money, I just work harder!

Thanks for reading @worldtravelfam and taking the time to comment. I can see that carrying everything in your back packs would certainly limit how much you buy.

Great post. Lots of good ideas even for the older traveller